Organisation of RIA International

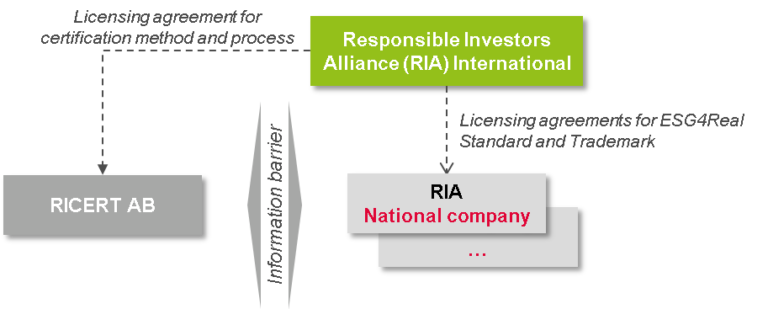

The organisational setup around RIA International (RIA Intl.) is designed to promote an open, transparent and market-driven concept, with a high degree of influence from asset owners and independent certification of asset managers. It includes three main types of entities:

- RIA Intl. is an international non-profit association where all ESG4Real licensed asset owners and certified asset managers are members. Other stakeholders who share the values and ambitions of RIA Intl. may also become members. Read more about governance of RIA Intl. below.

- RIA Intl. uses its affiliated RIA national companies to make ESG4Real available to customers and ensure advisory and training for compliance with ESG4Real. RIA national companies have the responsibility to perform marketing, sales, advisory and training. They have exclusive right to act on behalf of RIA Intl.

- Certification is performed through independent certification bodies, approved by the board of RIA Intl. and given the right to perform audits and certification via assignment and licensing agreements. To ensure credible audits and certification, there is an information barrier between any certification company and RIA national company

Governance of RIA International

To ensure efficient yet inclusive governance of RIA Intl., the governance structure has the following key principles:

- The annual general meeting (AGM) of RIA Intl. is the highest decision making organ with regards to key aspects in ESG4Real, e.g. content and development of the model and certification process

- Voting rights at the AGM are differentiated based on organisation- and membership type:

- Ordinary members (licensed asset owners and certified asset managers) are granted voting rights. Asset owners have 60% of votes and asset managers 40% of votes. As a decision requires a majority vote (>50%), this differentiation means that asset managers cannot make a decision without having a substantial part of asset owners on board

- Associated members (e.g. rating agencies and other service providers ) are not granted voting rights

- All members (ordinary and associated) are given the opportunity to be active via forums and working groups to provide input to RIA Intl., which enables a market-driven approach with knowledge provided by external stakeholders is incorporated into RIA Intl. and ESG4Real

- RIA Intl. has an executive board, which is appointed by the AGM. The board’s primary responsibility is to oversee operational processes with regards to e.g. model development and strategy of RIA Intl. The board may appoint working groups and hearings to generate suggestions that will be voted on at the AGM. Working groups will be composed to ensure the right competence

- Board members are nominated by an election committee with a majority of representatives being selected by asset owners and final appointment is made at the AGM in line with the 60/40-principle

Read full statutes of RIA International